Commercial evolution of the LNG market has accelerated over the last three years. This is the result of new and more flexible sources of supply. But it also reflects new market players, rising liquidity and a transition to shorter & more flexible contracting. As the LNG market grows and matures, substantial value creation opportunities are emerging.

These opportunities are reflected in the evolution of LNG market players. Big producers (e.g. Shell, BP, Total) are expanding their value chain presence. Trading focused intermediaries (e.g. Vitol, Gunvor, Trafigura) are driving liquidity growth and evolution of the traded market. Large buyers (e.g. JERA, Kogas, Pavilion) are expanding their portfolio footprints and developing commercial capabilities or JVs to support this growth.

One of the foundations of successful value creation is a robust commercial analysis framework, to tackle:

- Shorter term optimisation of portfolio flexibility, constraints & logistics

- Management of portfolio value via hedging & structured deals

- Creation of incremental portfolio value via new assets/LTCs or M&A

- Risk management of portfolio exposures

A successful analytical framework plays a key role in gaining a competitive edge when building and optimising an LNG portfolio. In today’s article we set key challenges and success factors in developing a solution. This draws on our first hand practical experience working with some of the largest players in the market to develop their in-house solutions.

5 key challenges of LNG portfolio analysis

Building an effective LNG portfolio analysis framework means confronting several key challenges.

1.Value chain interdependence

In many markets, liquid prices mean that portfolios can be valued and managed at an individual asset level. This is not the case with LNG portfolios. The value of LNG assets within a portfolio is interdependent, given the physical & contractual complexity of the LNG supply chain. As a result, valuation & optimisation needs to be tackled on a portfolio basis, recognising asset interactions & constraints.

2.Bespoke business models

Each LNG business model & portfolio has bespoke analytical requirements. These relate to the specific exposures, constraints & logistics of portfolio components. Requirements are also driven by the business model of the portfolio owner e.g. ‘trader’ focus on building portfolio optionality, ‘buyer’ focus on managing physical supply. The bespoke nature of the problem undermines the effectiveness of ‘off the shelf’ analytical solutions.

3.Illiquid markets

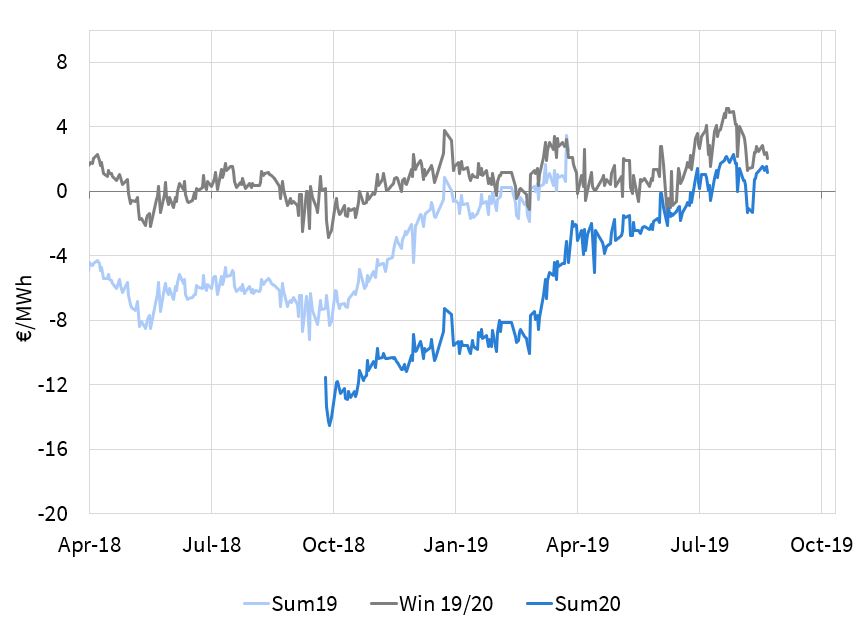

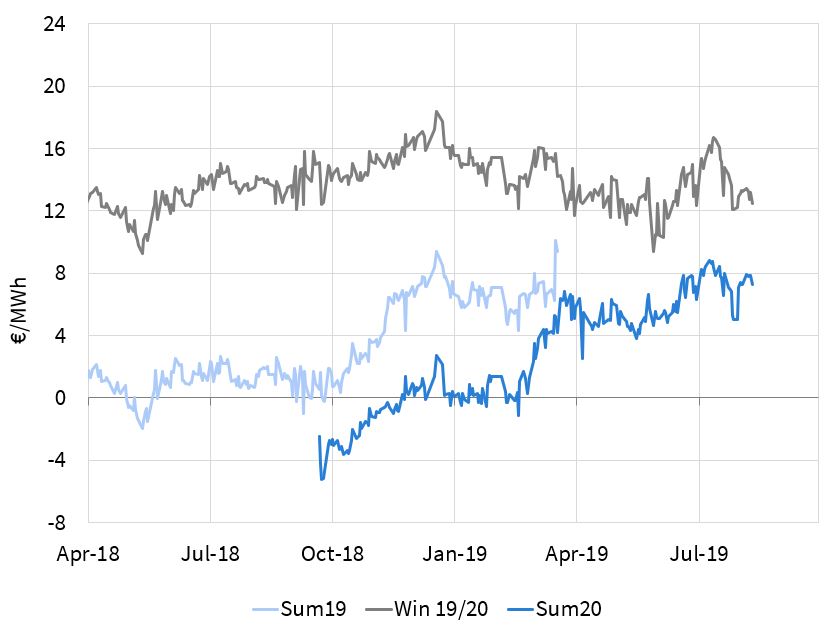

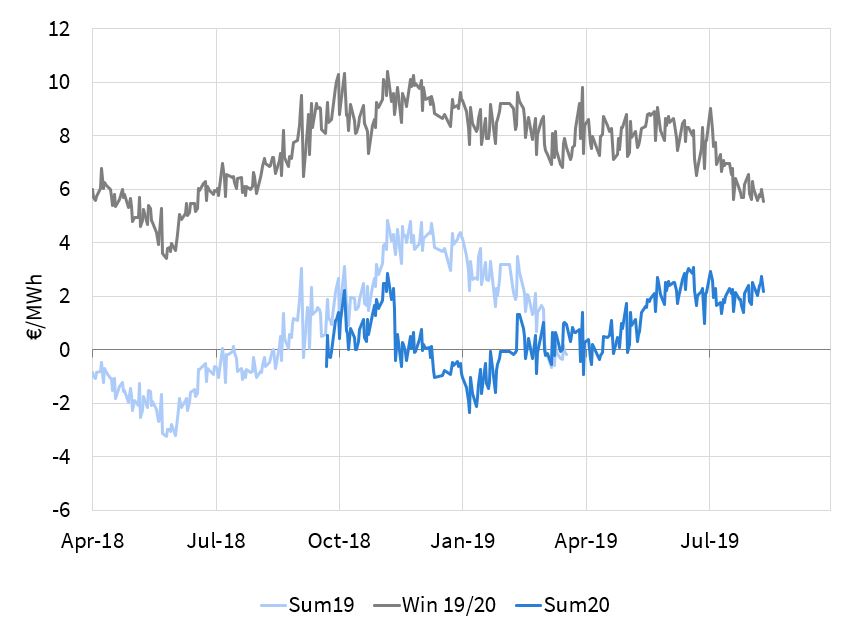

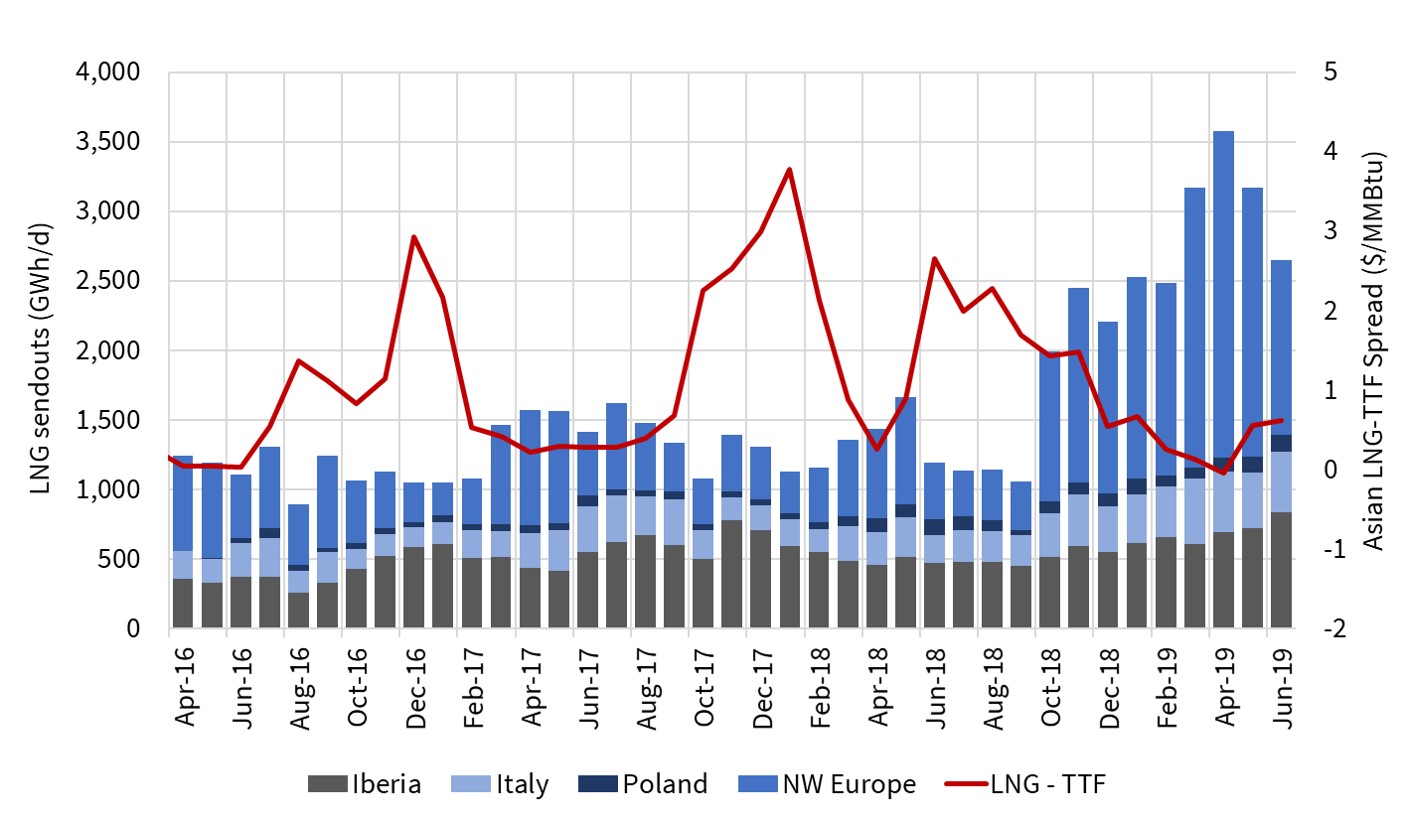

Despite rapid growth, the LNG market remains relatively illiquid & has complex physical & contractual logistical constraints (e.g. shipping, ports, canals, pricing & volume flex). This creates challenges in valuing & hedging complex (e.g. non linear) exposures. But these liquidity constraints also lie at the core of value creation opportunities. A transparent but robust deconstruction, optimisation & valuation of complex exposures underpins an effective analytical solution.

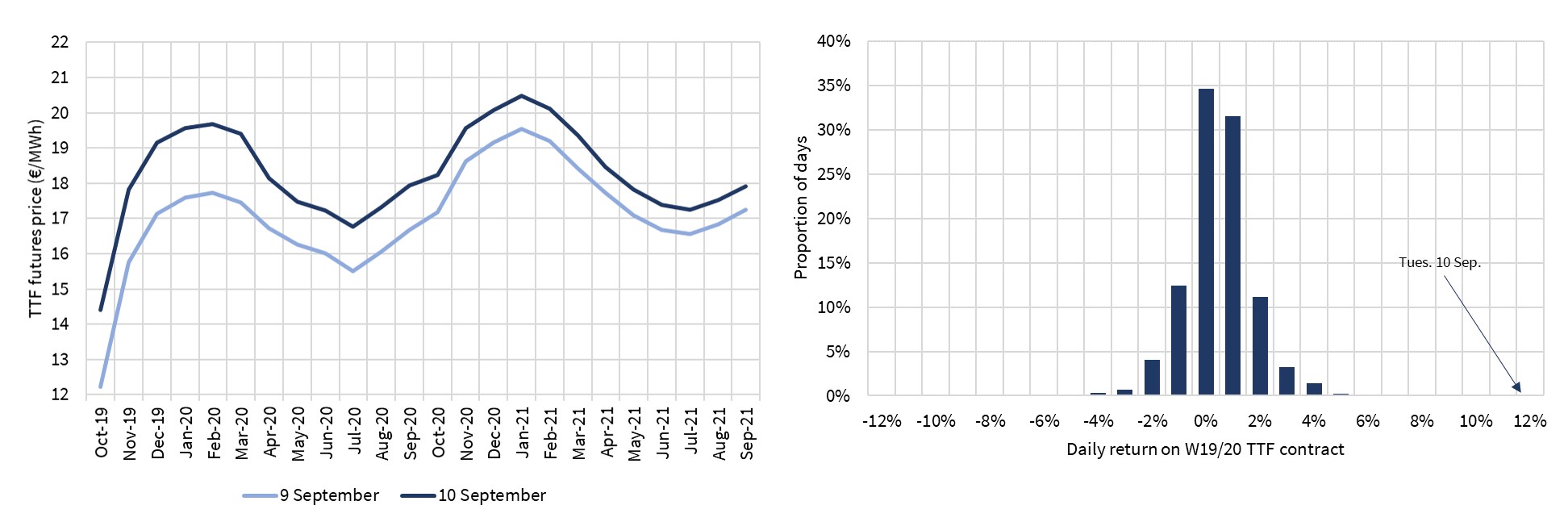

4.LNG price behaviour

LNG prices are not normally distributed! Standard pricing models do not capture complex relationships across LNG price markers. For example, the levels of price spreads, volatility & correlation depend on the prevailing ‘regime’ of the market. Pricing dynamics in a well supplied market tend to reflect convergence, high correlations and low volatility. In a tight market, prices temporarily diverge with correlations falling and volatility rising. Getting price analysis right can generate big competitive advantage.

5.Lack of standardised methodologies

Because of the 4 issues we set out above, there is a lack of standardised methodology for LNG portfolio analysis. As a result, companies are developing bespoke solutions. But a consistent approach is evolving across a number of the key analytical building blocks required (e.g. formulation of constraint problems, valuation approach for specific types of optionality). This is breaking down the barriers to developing an effective solution.

If those are the 5 key challenges, what are the success factors underpin a solution?

Creating & analysing LNG portfolio value

How is value created?

The most accurate answer is probably… in a pub over a ‘five o’clock’ beer.

But behind the deals that underpin a portfolio, value is created via the interaction between:

- Constraints & stress points in the LNG supply chain

- Changes in market dynamics.

Value is captured via constructing & optimising an appropriate combination of portfolio components & optionality. Understanding the way that portfolio value is practically created and monetised is the most important success factor in building an effective analytical solution. There is some important theory behind this, but theory on its own is useless.

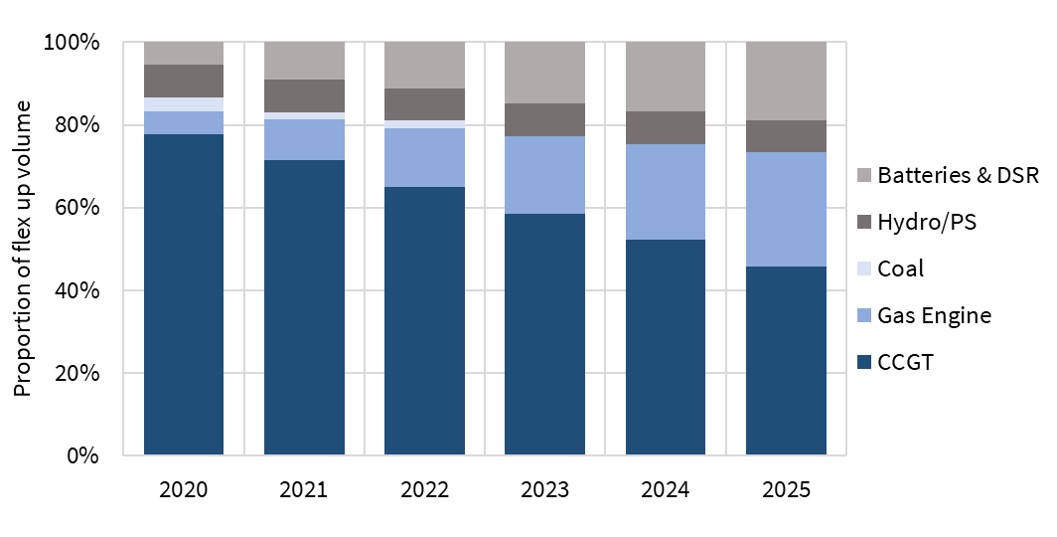

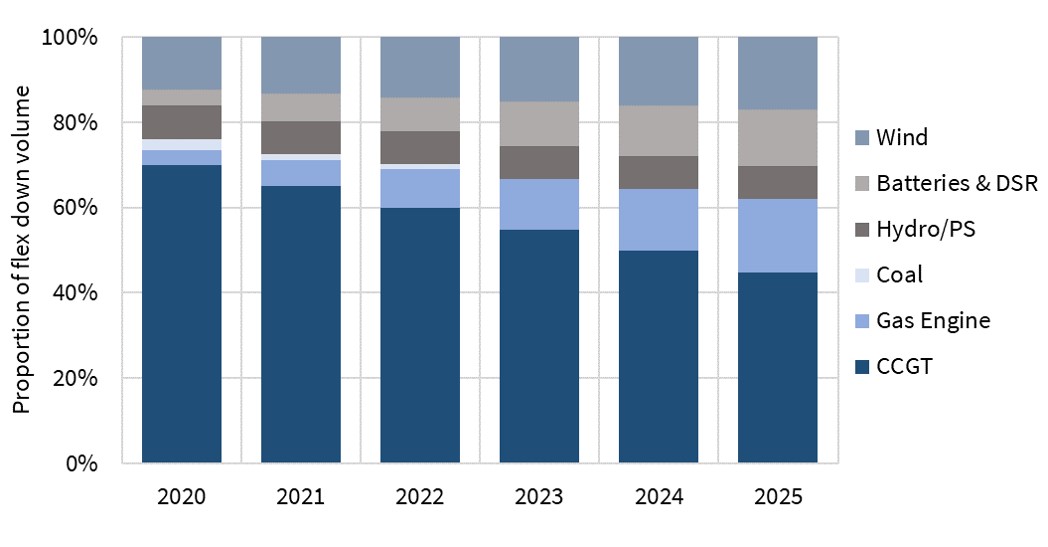

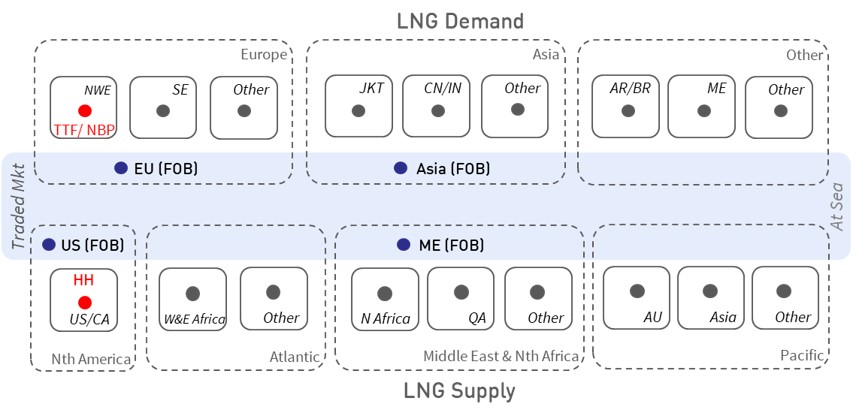

How is this represented analytically?

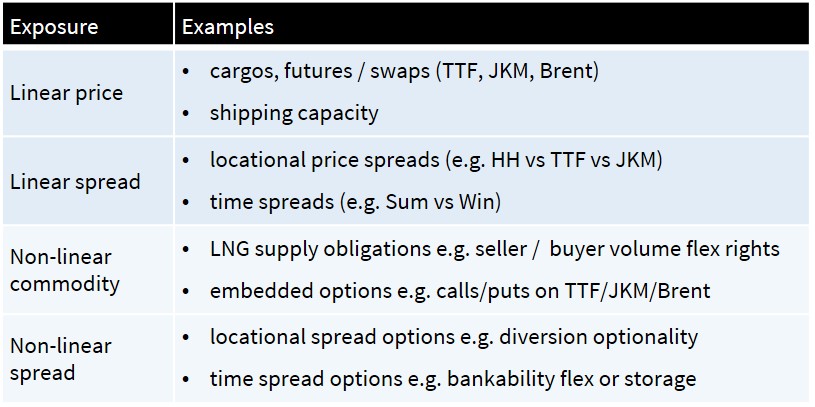

LNG portfolios can be simplified using market price ‘nodes’ and asset ‘exposures’. Market prices act on exposures to drive portfolio value. Diagram 1 shows a simple illustration of key LNG market price nodes. Diagram 2 summarises some key LNG portfolio exposures.

Diagram 1: An illustrative representation of key LNG price nodes

Table 1: Breakdown of some key LNG portfolio exposures

Source: Timera Energy

An effective analytical representation of an LNG portfolio is built on the definition of:

- Nodal price dynamics (price level, spreads, correlations, volatility), ref Diagram 1

- Portfolio exposures (e.g. commodity positions, asset flex & constraints), ref Table 1.

If you can define a realistic but transparent representation of the way price dynamics act on exposures, you are more than half way to cracking the problem.

Choosing the right weapon for the hunt

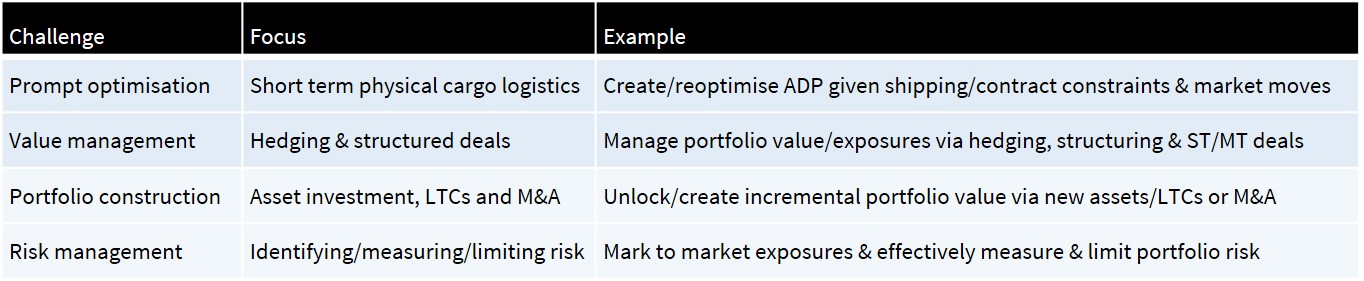

An effective analytical capability to support an LNG portfolio usually covers four distinct areas. These are summarised in Diagram 2.

Source: Timera Energy

There is a natural temptation to acquire an ‘elephant gun’ to tackle all four areas at once. This is a big mistake in our view. There can be common building blocks and a consistent approach, but a ‘one size fits all’ solution ignores the different nature of these four problems.

For example, an analytical tool to support prompt optimisation of portfolio cargo routing & logistics over a 6 month horizon, requires portfolio components & constraints to be represented in very granular detail.

It is ineffective and restrictive retaining that level of detail when analysing value management or portfolio construction over a 2-10 year horizon. Over this horizon, focusing on the impact of commodity price uncertainty is much more important than capturing detailed logistics.

The value of prototyping

Most players in the LNG market are developing their own in-house solutions. This reflects the pitfalls in trying to buy & configure an ‘off the shelf’ solution (as described in the 5 key challenges section above). A well constructed analytical solution can be a unique source of competitive advantage. It can literally pay for itself in a day, via increased value capture.

A key challenge in developing such a solution is effectively defining requirements and approach. It is very hard to do this in a ‘one shot’ upfront design phase. This is where we have found a simplified ‘proof of concept’ can substantially improve results and reduce costs.

The objective of this proof of concept approach is to build a functionally rich and commercially robust working prototype of the enduring analytical solution. This allows:

- Practical engagement with business users (e.g. originators, traders)

- More effective iterative definition of requirements & methodology

- Flagging of any major issues and the flexibility to address these

- Early & valuable insight into how analytical results can practically be applied in supporting commercial decision making.

Many elements of the proof of concept can often be efficiently adapted into part of the enduring solution.

For more details on how to tackle the development of an LNG portfolio analysis capability, we have included a link to a briefing pack below.

| Briefing pack: LNG portfolio value Sep 2019 Timera briefing pack with approaches and case studies on identifying & capturing LNG value: Gaining an edge |