With Christmas approaching this is our last article of 2014. We will be back with more in early January. To finish the year, it has become a bit of a tradition for us to look back at the key market and commercial themes of the past year. Then to draw on these themes to look forward into the next year.

2013 looking forward

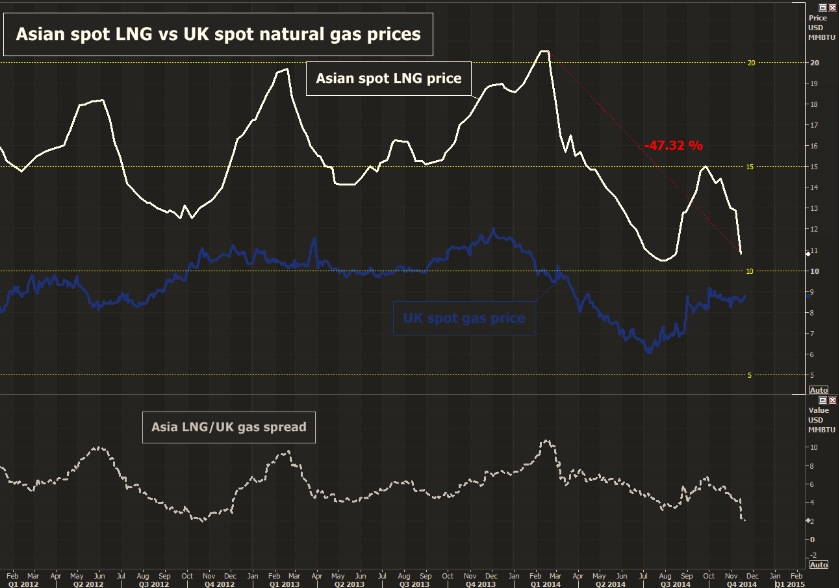

In Dec 2013, we published our end of year article with Brent crude around 110 $/bbl and Asian LNG spot prices above 18 $/mmbtu. At the time there was a strong consensus view that the gas and oil markets were tight and projected to remain so well through this decade. We finished 2013 with a list of potential energy market ‘shocks’ to consider coming into 2014:

- A period of surplus in the spot LNG market causing Asian spot prices to fall to a level where flexible supply flows back into European hubs.

- Another period of significant disconnect between European gas hub prices and oil-indexed contract prices (similar to 2009-10).

- A major slowdown in Chinese economic and industrial growth, e.g. reducing gas import demand and inhibiting a policy shift from coal to gas-fired generation.

- A significant fall in gas prices relative to coal, shifting the competitive balance back towards gas-fired generation.

- A prolonged period where oil prices fall back below 80 $/bbl.

- A pronounced policy shift away from support for low carbon generation capacity.

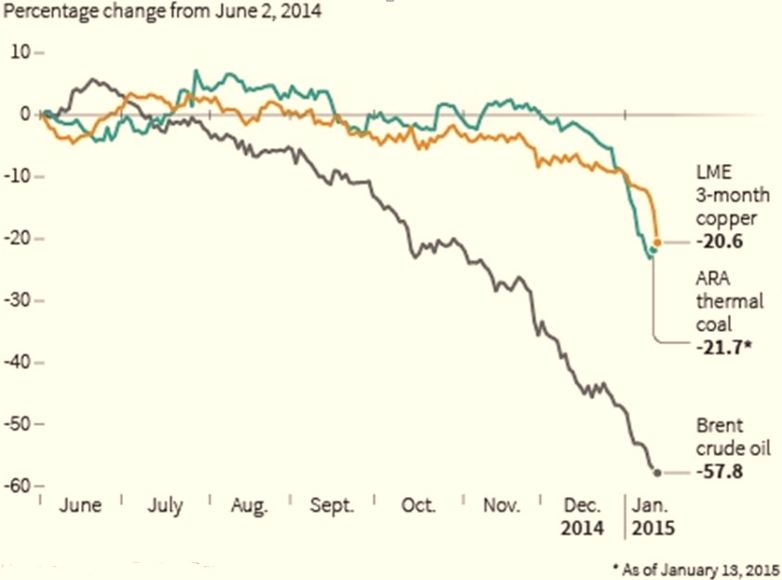

This was not a list of forecasts but a set of scenarios that we thought warranted prudent consideration. Most of these shocks have either transpired or sound a lot more plausible now than they did at the end of last year. In fact weakening oil and LNG prices have become a reality in 2014 with a profound impact on energy portfolio exposures. The knock-on effects are being felt across European gas and power markets and will likely determine the way forward into 2015.

2014 looking back

LNG market:

Both the short term and the longer term balance in the LNG market have shifted towards oversupply in 2014.

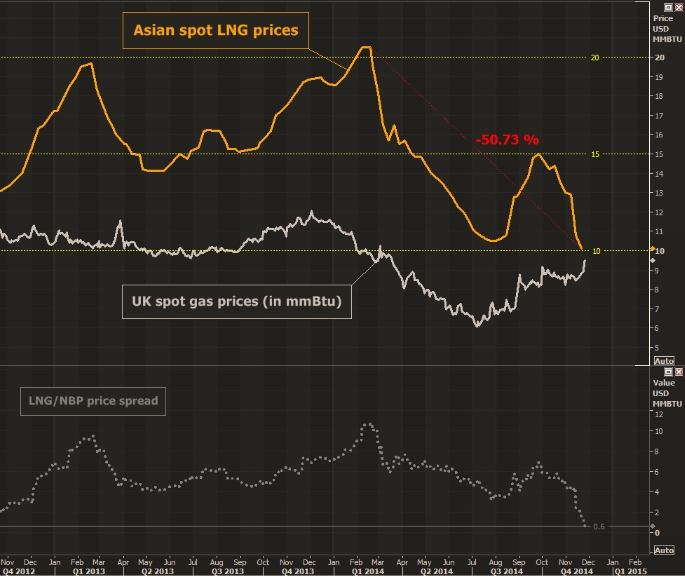

The LNG spot market is an increasingly good barometer of shorter term global gas market balance. A 50% decline in spot prices since January provides a good indication of the profound shift that has taken place across this year. The big move lower came in Q2 with prices falling towards 10 $/mmbtu. Cargoes flowed back into Europe as the Asian diversion arbitrage dried up and as LNG was sold into European hubs as a market of last resort. Any theories that this was a seasonal phenomenon have been dashed by renewed spot price weakness in Q4.

Perhaps more importantly the longer term balance also appears to be shifting towards oversupply. The LNG market has now weathered the ‘drought’ of new supply across the 2011-14 period. From 2015 new liquefaction projects, particularly in Australia and the US, start to ramp up. Not all of these projects are fully contracted suggesting more pressure to come on spot prices.

Towards the back end of the decade Russian pipeline gas poses an increasing threat. Russia signed framework agreements for a massive 68bcm of gas exports to eastern and western China in two separate deals this year. That is likely to put a substantial dent in China’s LNG import growth appetite from later this decade. It also puts Russia in the box seat to undercut LNG producers in making incremental sales to China going forward.

These factors are shifting the LNG market balance back towards buyers. A Japanese buyer (Chubu Electric) recently signed a 20 cargo deal with a partially spot indexed structure. Look out for an evolution in LNG contract structures and pricing terms if market oversupply continues.

European gas markets:

Events at European gas hubs in 2014 have been strongly connected to the LNG spot market. In a year where demand has remained relatively weak and pipeline supplies robust, an increase in LNG imports has weighed on prices.

The fall in hub prices over the summer of 2014 was on a similar scale to the slump in spot LNG prices. European hubs acted as key price support for the global gas market across the summer. But hub prices fell well below long term oil-indexed contract prices. This oil vs hub price divergence has eased into the winter, but it foreshadows problems that may lie ahead for suppliers who remember the pain of 2009 & 2010.

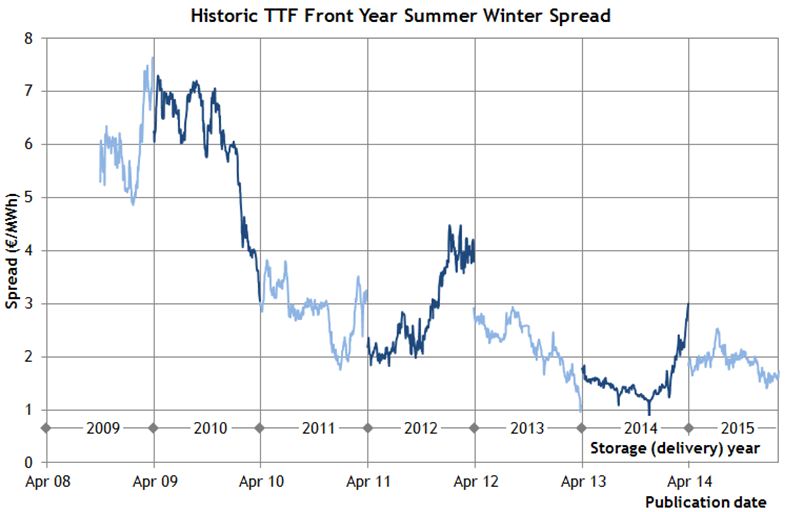

Chart 1 provides an illustration of historical TTF price evolution through the post-Fukushima phase of market tightness (2011-13) and the transition towards oversupply in 2014. It also indicates the current state of play in the forward market, with TTF pricing up towards oil-indexed contract levels in the winter periods.

Chart 1: TTF historical and forward price benchmarks

Source: Reuters

The events of 2014 have also seen the start of a recovery in seasonal price spreads and volatility. Interestingly this has occurred against the backdrop of falling hub prices, illustrating that oversupply does not necessarily reduce gas flexibility value. In the past wider spreads and higher volatility have tended to coincide with periods of higher hub prices. The pickup in spreads and volatility has also seen a renewed interest in gas flexibility products such as storage capacity.

As the year draws to a close, the European market remains focused on the threat of Russian supply cuts. But with robust gas storage levels across Europe and pronounced weakness in spot LNG import prices, this threat looks much more manageable than it appeared to be earlier in the year.

European power markets:

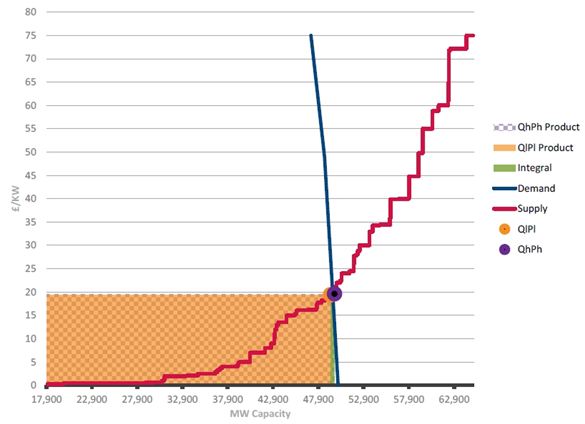

One of our themes in 2014 has been on the implementation of capacity markets across Europe. It is becoming clear that capacity markets will be the mechanism of choice to support thermal capacity in a world of low carbon support.

The UK is the first large European power market to lead the way with an auction this month. France is next and Germany looks to be following later in the decade. Market designs are likely to differ significantly and these differences may have profound impacts on generation margins and wholesale power price dynamics. The interaction between capacity and energy market pricing is a big story for power station owners and investors going forward.

We have also focused this year on the evolution of thermal power station value in Europe. The world of guaranteed baseload running has gone. As renewable output increases, gas and coal plants are increasingly playing a mid-merit and peaking role. These assets are essentially strips of options on the clean spark or dark spread. Asset ownership will likely evolve over time towards players who are able to understand and monetise the risk associated with this optionality.

Power asset transactions have started to pick up in 2014. Change in ownership patterns are suggesting a shift from utilities towards independent generators and investment funds. This is partly driven by balance sheet constraints and partly by a continuing negative outlook on generation margin returns. There have been some big portfolios on the block e.g. Vattenfall’s German assets and E.ON Spanish assets (recently purchased by Macquarie). E.ON’s announcement last week that it will spin off a separate listed entity containing its generation assets and trading business is another indication of utility appetite to shed generation asset exposures. We expect more to follow in 2015.

Looking forward into 2015

We ended last year with a list of potential shocks that could threaten market consensus. A number of these shocks have been delivered in 2014 (driven by falling oil, LNG and gas hub prices). We suspect that the market transitions taking place in 2014 will continue to shape events through 2015.

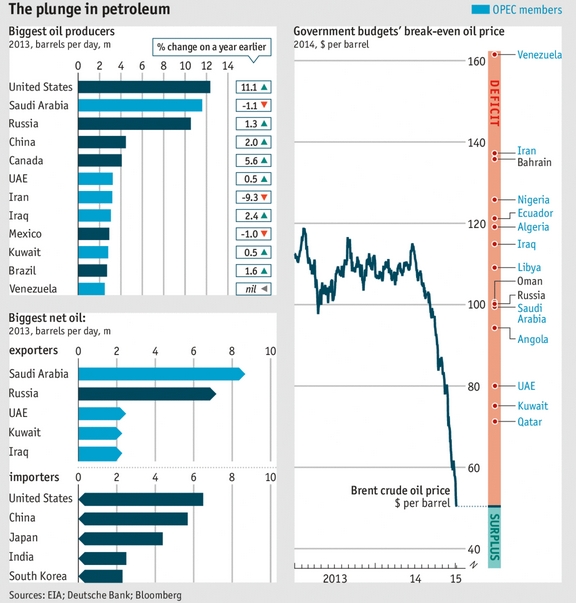

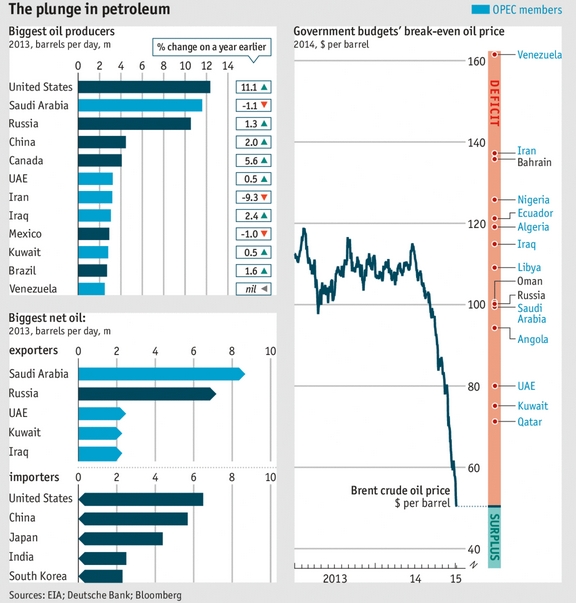

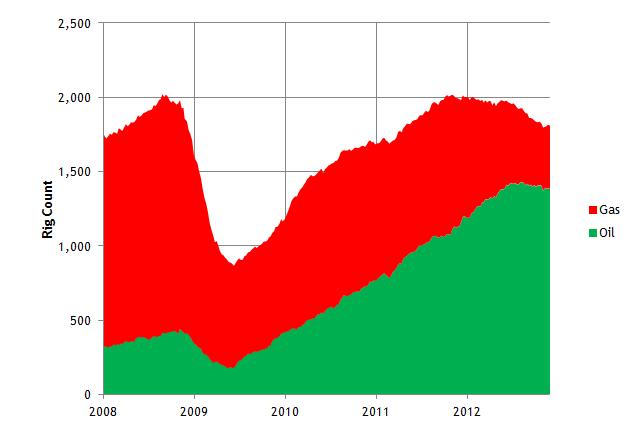

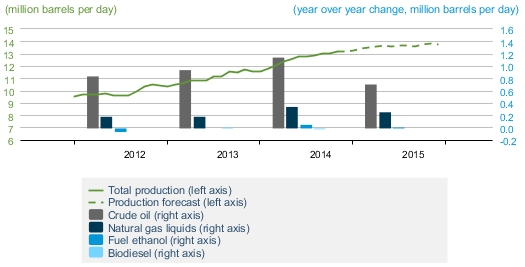

OPECs battle for market share against a backdrop of weak demand suggests there may be a sustained period of lower crude prices. Crude price recovery may require significant volumes of marginal supply to be driven out of the market as a result of lower prices (e.g. US shale oil).

For the LNG and European gas markets, lower crude prices are already a ticking fuse given lagged long term contract oil-indexation. This may be compounded by a spot market oversupply of gas, particularly coming into next spring. There is currently a lot of gas stored in anticipation of spot market tightness over the winter. If that fails to transpire, stored gas and increasing LNG flows may send spot prices spiraling lower in Q1.

As new LNG production ramps up in 2015 there looks to be a key risk that the trends of 2014 continue, potentially leading to a gas glut similar to that of the 2009-10 period. Important for European suppliers will be to what extent gas hub prices disconnect from oil-indexed contract prices again.

For European power markets, the factors above may lead to some rebalancing in gas vs coal plant competitiveness. Across the 2012-14 period coal prices have slumped to levels below the long run marginal cost of production. This has moved coal plants up the merit order to have a clear variable cost advantage over CCGTs. But if gas prices decline relative to coal prices in 2015, this may support an increase in gas plant load factors and margins, particularly in markets with a higher proportion of gas-fired capacity (e.g. the UK).

All of the above is hypothesis based on the impact of a continuation in the trends set in place in 2014. But the future is no more certain now than it was at the end of last year. We finished 2013 by emphasising the importance of stress testing asset & portfolio returns to understand the potential impact across a plausible range of market outcomes. That logic applies just as much now as it did then.

Happy Christmas

2014 has seen our readership approximately double, with our base of regular readers rising towards 10,000. We have again been widely published in industry journals and the press as well as speaking at a several conferences. We appreciate your support and look forward to bringing you more in 2015. In the meantime we wish you all the best for a relaxing break over the Christmas period.